|

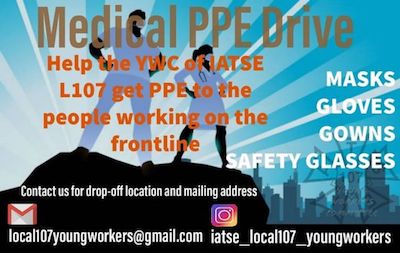

IATSE LOCAL 107 Young Workers Medical PPE Drive

|

|

|

|

|

The IATSE Local 107 Young Workers Committee goal of delivering PPE to essential workers and keeping our communities safe has been accomplished. Thanks to you and others like you, our PPE drive has come to a climactic conclusion! You answered our call for help.

On behalf of the IATSE Local 107 Young Workers Committee and IATSE Local 107, thank you for supporting our PPE drive. Without your generous financial contributions to a GoFundMe account created by Kale Sassaman, your donations of materials and the countless hours of time you gave making masks, we would not have been able to achieve our goal of helping essential workers stay safe while working and helping to slow the spread of the Covid-19 virus in our community! A very special thank you goes out to IATSE TWU 784 and The Seamsters Union. Without their tireless work to turn raw materials into finished masks, much of what we accomplished would have been impossible.

Ultimately, we produced and delivered 993 masks. The recipients were the hard working men and women of the United Farm Workers of California.United Farm Workers members toil in the fields across our great state to make available the food that we feed our families everyday. We could not think of a more well deserving group of workers to receive the PPE!

Again, thank you all for following our work and supporting it with your time, resources and money. Together we brought relief to our community and PPE to frontline workers! Please continue to return to this site to learn how you can participate with the Local 107 Young Workers! You can find us on Instagram at iatse_local107_youngworkers and on Facebook at Local 107 Young Workers.

We will continue to engage with our community and grow solidarity in and out of our membership in hopes of growing Union density and awareness! Thank you for your work and participation!

|

|

|